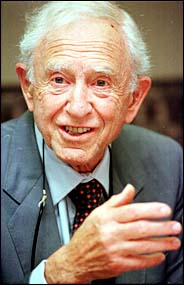

Franco Modigliani wrote a Letter to the Editor of the New York Times that was published on Tuesday. His obituary was published today. One day at a time, everybody. One day at a time.

Franco Modigliani, 85, Nobel-Winning Economist, Dies

Franco Modigliani, who received the Nobel Memorial Prize in Economic Science in 1985 for his pathbreaking explanations of how people save and the role of debt in determining the value of corporations, died yesterday at his home in Cambridge, Mass. He was 85.

He died in his sleep, the family said. The evening before, he and his wife, Serena, had attended a dinner in honor of a fellow economist, John Kenneth Galbraith, and Mr. Galbraith’s wife. Mr. Modigliani had taught at the Massachusetts Institute of Technology for 28 years, until he retired in 1988, but continued to teach at least one course each spring.

Mr. Modigliani, who was Jewish, often recounted his experiences with fascism in his native Italy. As a young man just out of law school [~] active in the antifascist movement [~] he fled to France and then the United States after Mussolini promulgated racial laws in 1938. His enduring hatred of the Mussolini government flared up one last time this week.

In a letter to The New York Times published on Tuesday, he protested the decision of the Anti-Defamation League to present Prime Minister Silvio Berlusconi of Italy with its Distinguished Service Award. Mr. Berlusconi had been quoted as saying that Mussolini did not murder anyone; he only sent them into long exiles. Mussolini in fact “was responsible for the deaths of many political opponents, partisans and Jews,” Mr. Modigliani wrote in the letter, which was co-signed by two other Nobel laureates, Paul A. Samuelson and Robert M. Solow, also of M.I.T.

Mr. Modigliani never practiced law. Midway through law school at the University of Rome, he discovered a talent for economics, finishing first in a national essay competition on economics. Once in New York, he pursued that new career, earning a doctorate from the Graduate Faculty of Political and Social Science of the New School for Social Research in New York. The New School was a haven, as Mr. Modigliani put it in an autobiographical sketch written at the time he received the Nobel, “for European scholars who were victims of the fascist dictatorships.”

His various early teaching jobs brought him to the Carnegie Institute of Technology in Pittsburgh in the 1950’s. There he developed the life-cycle hypothesis, his best-known work. Economists had thought that only the rich saved, or people saved only when their incomes rose. Mr. Modigliani, who persisted in testing theories against experience, doubted this. Talking it through with Richard Brumberg, then a graduate student, he came up with the insight that everyone saves and accumulates wealth through the early decades of their lives and then spends the accumulated wealth in old age.

Across a nation, savings rise as an economy and a work force grow and productivity rises, Mr. Modigliani concluded. After World War II, that was the experience of the United States, then Japan and now China. In life-cycle theory, the accumulated American savings should be spent soon by the baby boomers now approaching old age.

“Modigliani’s theory was a powerful searchlight on what was happening,” Professor Samuelson said. “It is the best explanation of what has actually been happening in the great swing of American life since the 1950’s.”

Holding this view, Mr. Modigliani criticized what he considered the dissipation of built-up national savings as a result of the Bush administration’s tax cuts and the rising deficit. In a similar vein, he has opposed the various Social Security privatization plans and had planned to reiterate his views in a meeting with two congressmen this week, his family said. As it now stands, Social Security gives poor people a greater return relative to their contributions than higher-income Americans, Mr. Modigliani argued.

The Nobel he received in 1985 also honored him for his insights into corporate financing. Working with Merton H. Miller, who won a Nobel in 1990 for his contribution, Mr. Modigliani demonstrated that leveraging a company through a lot of debt did not in itself affect a corporation’s value.

Until Mr. Modigliani and Mr. Miller came along, much attention had been devoted to determining just the right mix of debt and equity. But the payoff from expansion through debt, for example, is offset by the risk that the company might not be able to repay the debt. What investors focus on, in fact, is profitability, and they offset the risk of purchasing stock in a leveraged company by holding safer investments in their portfolios.

Mr. Modigliani thought of himself as a Keynesian who nevertheless melded Keynesian theory with classical economic concepts. He believed, as the classicists do, that economies reach an equilibrium. The demand and supply of labor, for example, balance each other [~] but not always at the high level of employment that classical economic theory postulates.

Mixing in Keynesian stimulus [~] that is, a combination of public spending and central bank manipulation of interest rates [~] he played a big role in developing a forecasting model still used by the Federal Reserve and by private forecasters.

Franco Modigliani was born on June 18, 1918, in Rome to Enrico and Olga Modigliani. His father, a prominent pediatrician, died when Mr. Modigliani was 13 and his schoolwork, in response, “became pretty spotty,” he recounted years later in the biographical sketch, “until I moved to Liceo Visconti, the best high school in Rome, and the challenge proved healthy and I seemed to blossom.”

“Encouraged, I decided to skip the last year of the Liceo, passed the required difficult exams and entered the University of Rome at 17 (two years ahead of the norm),” he added.

His family had wanted him to be a doctor; he chose law, “which in Italy, opens the way to many career possibilities,” he wrote.

Forced to leave Rome, he went to Paris to join the family of his future wife, Serena, whose father, Giulio Calabi, was a noted antifascist. The couple married when he was 20 and she was 19. Mrs. Modigliani survives, along with their sons, Andre, a professor of social psychology at the University of Michigan in Ann Arbor, and Sergio, an architect in Brookline, Mass.; four grandchildren and three great-grandchildren.

The Modiglianis arrived in New York in August 1939, a few days before the outbreak of World War II. “I immediately began thinking on how best to pursue my interest in economics,” Mr. Modigliani wrote. By early fall, he had embarked on a routine that would last for the next three years, studying economics in the evenings and selling books by day to support his family.

In his memoir, “Adventures of an Economist,” published in 2001, Mr. Modigliani said that the crucial figure in his education as an economist was Jacob Marschak, a Russian teaching in Germany who had fled Hitler, landing at the New School.

“Marschak at once took a liking to me and, first, gave me to understand that if I wanted to get ahead as an economist I should study more mathematics,” he wrote. “That was a field in which I had no grounding [~] indeed, ever since secondary school I had felt some aversion to it. But now Marschak persuaded me to apply myself seriously.”

After receiving his doctorate in 1944, he embarked on a career that brought him to a dozen posts before he arrived at M.I.T. from Carnegie as a visiting professor in 1960. He earned tenure in 1962 and had appointments in both the Economics Department and the Sloan School of Management. Through all these years he acted as a consultant to Italian governments. “Every conversation you had with Franco started with a dissertation about Italian politics,” said Charles M. Vest, M.I.T.’s president.

His early career brought him for a while to the University of Chicago, Harvard University and the University of Illinois, where he met Mr. Brumberg and began the collaboration that eventually produced the life-cycle theory, first published in separate papers in 1953 and 1954. Mr. Brumberg died in 1955, and Mr. Modigliani delayed the publication of a final “aggregate” paper until 1980.

“Brumberg’s untimely death,” Modigliani wrote, “sapped my will to undertake the revisions and condensation that would have been required for publication in one of the standard professional journals.”